Previously, Anti-money laundering (AML) models relied on qualitative, expert judgment components. While these models still rely on expert judgment, they are coupled with more advanced scoring algorithms and have other quantitatively derived factors, such as segmentation and thresholds.

Financial crime validation is the set of processes and activities intended to verify that models are performing as expected, in line with their design objectives and business uses.

At Contineo, our model validation approach has been informed by the official guidance issued by the US Federal Reserve. Ref: The Fed – Supervisory Letter (federalreserve.gov)

Financial Crime Validation Process

Our Financial Crime Validation process covers 4 main steps when working with any bank or financial institution. Our experienced SMEs conduct the below:

1. Conceptual Soundness Assessment

This step involves assessing the logic process that was implemented, documentation review and artefacts referencing the model design. This process is intended to identify any gaps or deviations from the design at implementation.

The model is then benchmarked with the industry standards and a finding report is generated.

2. Data Lineage Assessment

The next stage emphasises on the key element fed to the model – data. This phase focuses to ensure that all the data that the model expects is being delivered to the model in its entirety, and consistently. This is achieved by assessing the data fed into the model for monitoring, with fields marked for monitoring etc.

3. Model Implementation Testing

The purpose is to assess the detection scenario’s and appropriateness of the analysis and testing performed at the time of model implementation. This entails an evaluation of the evidence based on which the model parameters were selected for monitoring and also over all detection scenarios implemented for monitoring.

4. Outcome Analysis

The key focus at this stage is to ensure that all expected alerts are returned, and that red flags are highlighted with appropriate alert priority. The assessment focuses on if the model returns the expected minimum (i.e. expected alerts) and a wider assessment of effectiveness and efficiency of the alerts returned by the model.

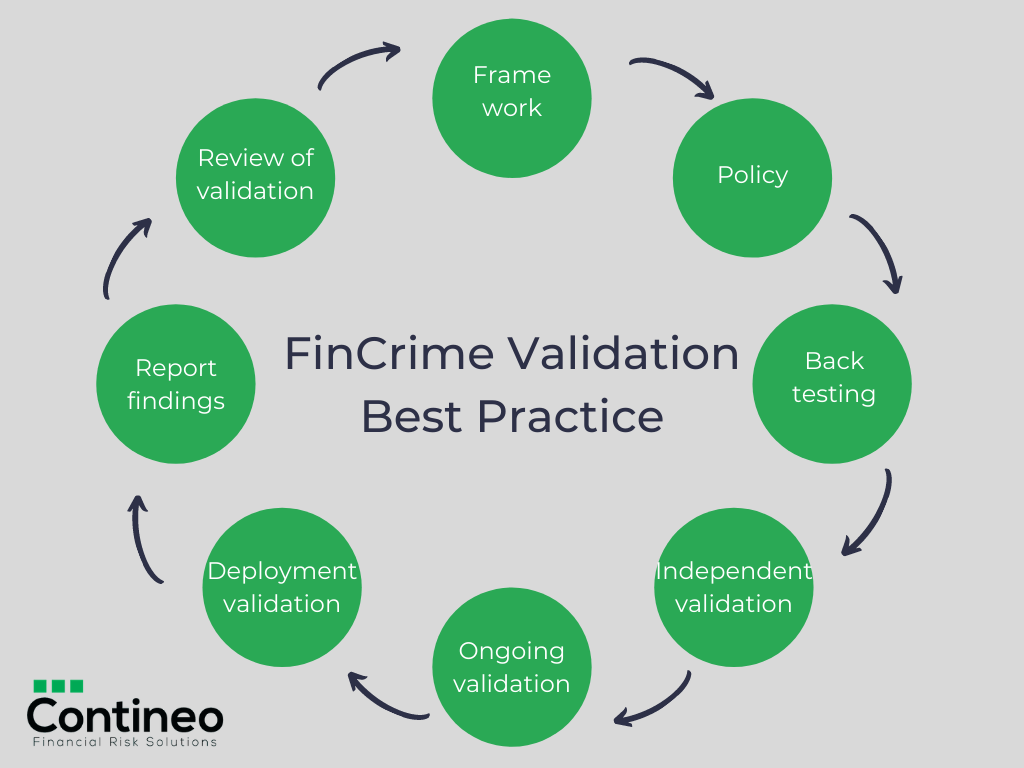

Financial Crime Validation best Practice

While FinCrime model validation can be performed, following the best practices will aid in the exercise being effective.

Establishing the Framework

Model validation framework: A strong and robust Model Risk Management framework should set out key guidelines, processes and methods, and roles and responsibilities covering model validation activities.

Model validation policy: All policies should reflect the necessary details and exceptions arising from different activities and subsidiaries.

Established backtesting framework: It is critical to establish a robust back testing framework in order to determine a model’s ability to capture risk exposure.

Validating the Model

Independent validation:

It is important to carry out model validation to be effective and unbiased. This includes carrying out an independent review of model validation activities, separate from model development.

Ongoing model validation:

The Fed recommends that back-testing of models expected, and outputs should take place at least annually. However, the frequency may vary depending on the nature and complexity of the model.

Pre and post deployment validation: It is best practice to carry out validation not only before deployment but also at frequent intervals and at the point of change deployments.

Reporting and reviewing

Reporting findings: For an effective validation process, all findings and outcomes along with severity must be reported to designated teams, so that it can be remediated in a timely manner.

Review of validation issues: Any weaknesses or gaps identified during validation should be documented and monitored closely, so that they are resolved promptly.

How can Contineo FRS help?

Financial Crime Validation is one of our niche specialist areas which we can help with. We understand model design by identifying your organisational AML risks, ensuring rule tuning is consistent and validating all data limitations across functionality, inputs, outputs and scenario design. Our team will be happy to give you a free consultation on our FinCrime Validation services. Simply email [email protected] to book an appointment today.

Keep up-to-date with industry information by following our LinkedIn page.